Tag: Trade Republic

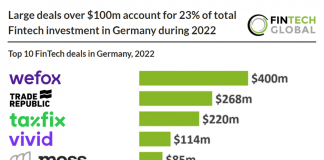

Large deals over $100m account for 23% of total FinTech investment...

German FinTech investment stats in 2022:

• German FinTech investment reached $4.3bn in 2022, a 47% drop from 2021

• FinTech deal activity in Germany dropped...

Neobroker unicorn Trade Republic extends Series C by €250m

German neobroker Trade Republic has closed a €250m Series C extension round, which puts its valuation at €5bn (up from €4.4bn).

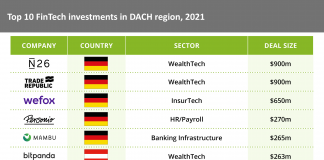

German companies account for seven of the top ten FinTech investments...

N26, an online bank, saw the largest investment in the DACH region during 2021 with a $900m funding round led by Third Point Ventures...

UK companies account for half of the top ten new European...

Europe accounted for 15% of new FinTech unicorns in 2021 with 22 representatives headquartered on the continent. UK companies lead the way with 13...

Don’t miss the 11 biggest FinTech deals of 2021

Billions of dollars are invested into FinTech companies each year and 2021 was no different. The sector has seen eye watering amounts of capital deployed into the sector, but what companies made out with the most?

FinTech companies make up a third of all new unicorns in...

There were 151 FinTech companies among the 457 new unicorns across all industries this year

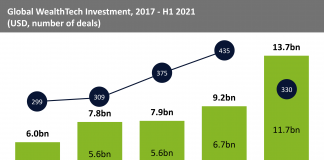

Global WealthTech funding sets a new record in 2021 after $13.6bn...

H1 2021 surpasses entirety of 2020 funding by $4.4bn, boosted by large deals over $50m

Why the 46 FinTech rounds from last week are exciting for...

With Trade Republic netting $900m and four startups earning the horn among 46 rounds, last week proved to be a great week in terms of FinTech investment, particularly for stock trading apps enterprises.

Neobroker Trade Republic achieves $5bn valuation after massive Series C round

German stock-trading app Trade Republic raised $900m in Series C funding which valued the company at over $5bn - a figure that soared from $600m from last April.

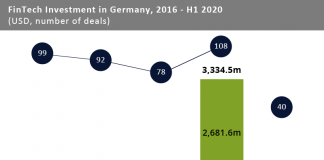

The German FinTech sector is likely to suffer its first decline...

FinTech funding in Germany in H1 declined by 73.3% compared to the opening six months of 2019.