Tag: UK

UK still dominate the top 10 FinTech deals in Europe amid...

2023 has seen a stark comparison to the previous year with no European FinTech deals reaching the $1bn mark, compared to two in 2022....

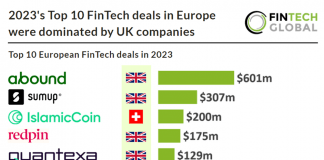

2023’s Top 10 FinTech deals in Europe were dominated by UK...

2023 has seen a stark comparison to the previous year with no European FinTech deals reaching the $1bn mark, compared to two in 2022....

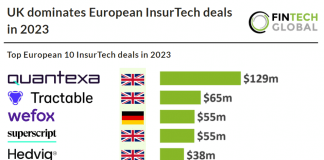

UK dominates European InsurTech deals in 2023

Key European InsurTech investment stats in 2023:

• European InsurTech deal activity totalled at 126 deals in 2023, a 44% reduction from the previous year

•...

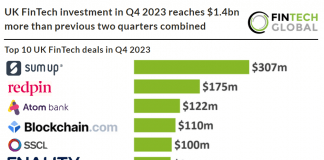

UK FinTech investment in Q4 2023 reaches $1.4bn more than previous...

Key UK FinTech investment stats in Q4 2023:

• UK FinTech deal activity totalled at 72 deals a 56% reduction from Q4 2022

• UK FinTech...

AXA UK&I welcomes Alain Zweibrucker as new CEO of AXA Retail

AXA UK & Ireland has named Alain Zweibrucker as the CEO of AXA Retail, effective 2 January 2024, pending regulatory approval.

Lithuanian FinTech PAYSTRAX launches in UK

Lithuanian FinTech PAYSTRAX has launched in the UK having received its Payment Institution License from the Financial Conduct Authority (FCA).

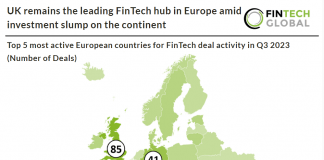

UK remains the leading FinTech hub in Europe amid investment slump...

Key European FinTech investment stats in Q3 2023:

· European FinTech deal activity reached 233 deals in Q3 2023, 56% drop YoY

· European FinTech companies...

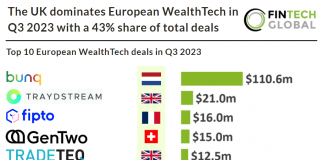

The UK dominates European WealthTech in Q3 2023 with a 43%...

Key European WealthTech investment stats in Q3 2023:

· The UK recorded the most WealthTech deals in Europe with 13 transactions in Q3 2023

· European...

Unveiling insights from financial leaders: The state of communications compliance in...

As penalties continue to rise for record-keeping failures, a new report from Theta Lake found that almost 98% of financials services leaders it surveyed were...

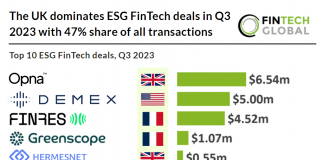

The UK dominates ESG FinTech deals in Q3 2023 with 47%...

Key ESG FinTech investment stats in Q3 2023:

• ESG FinTech deal activity in Q3 2023 reached 17 deals, a 10% drop QoQ

• ESG FinTech...